India’s Next Refining Wave: BPCL and PSU Partners Redraw the Downstream Map

9

NOV

India’s Next Refining Wave: BPCL and PSU Partners Redraw the Downstream Map

Bharat Petroleum Corporation Limited’s recent downstream initiatives mark a notable shift in how India’s public-sector oil companies are approaching long-term growth. Rather than focusing purely on incremental refining capacity, BPCL’s latest investments emphasise integration- linking refining, petrochemicals, logistics, and energy transition projects into a single strategic framework. This approach reflects a broader industry reality: as conventional fuel margins become increasingly cyclical, future competitiveness will depend on scale, product diversification, and tighter control over downstream value chains.

In late-October 2025, state-owned Bharat Petroleum Corp. Ltd. (BPCL) entered three strategic memoranda of understanding (MOUs) with partners Oil India Ltd. (OIL), Numaligarh Refinery Ltd. (NRL), and Fertilisers & Chemicals Travancore Ltd. (FACT) to develop greenfield projects across India’s petrochemicals, refining, logistics, and green energy sectors. These efforts aim to expand and optimise the country’s downstream ecosystem, aligning with India’s goals for energy self-reliance and enhanced integration.

Ramayapatnam Integrated Complexs

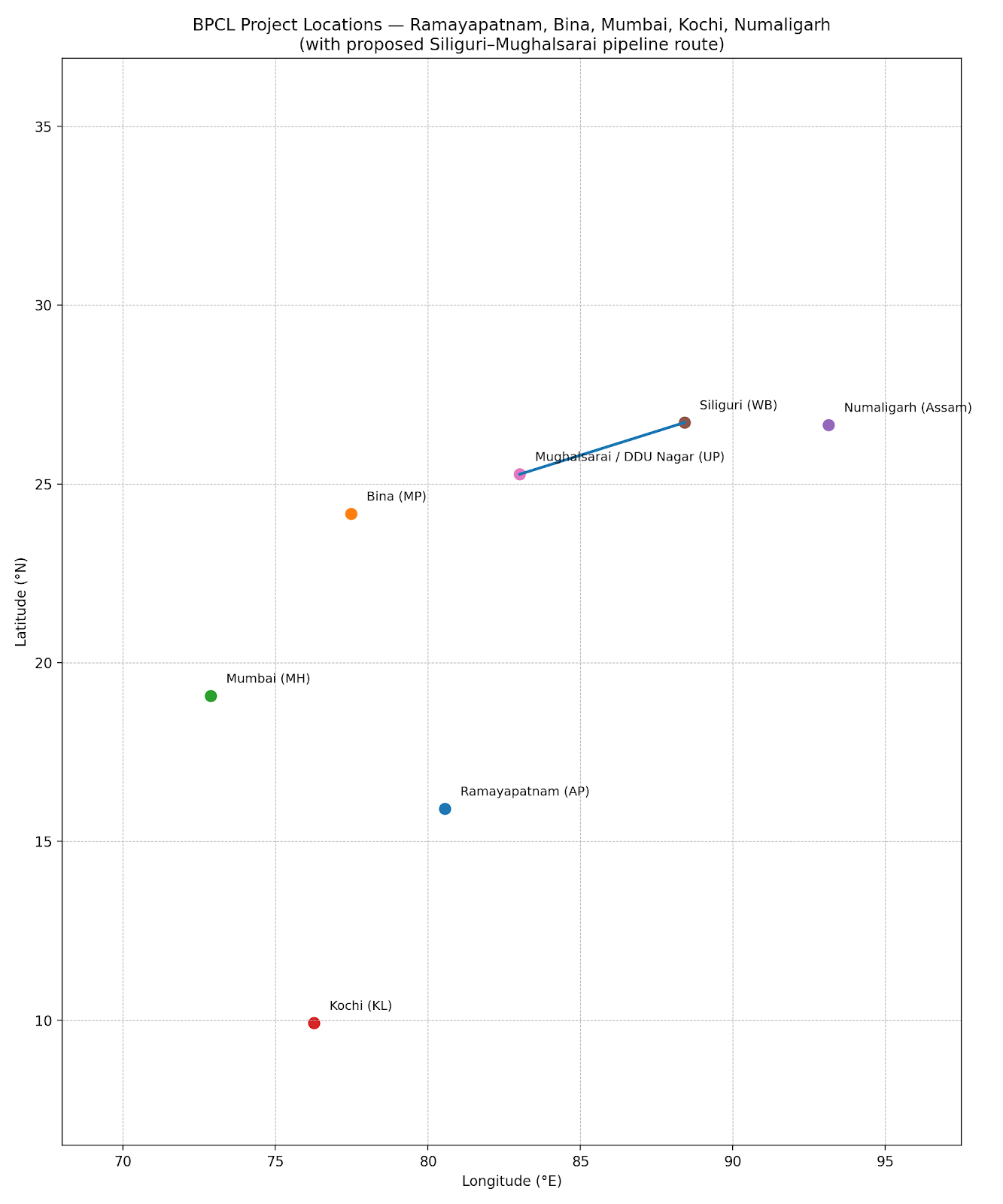

A central element of BPCL’s expansion roadmap is the proposed greenfield refining and petrochemical complex at Ramayapatnam port in Andhra Pradesh, being evaluated in partnership with Oil India. The project is envisioned as a large, integrated facility rather than a standalone refinery, underscoring BPCL’s intent to move deeper into petrochemicals alongside fuels.

Current configurations under consideration indicate a crude processing capacity in the range of 9- 12 million tonnes per year, coupled with a 1.5 million tonnes per year ethylene cracker. If executed as planned, this would represent the first major petrochemical cracker installation in southern India, with an estimated petrochemical integration intensity of roughly 35%. Capital expenditure for the complex is expected to be approximately ₹1 trillion (around $11.4 billion), placing it among the largest downstream investments proposed by a public-sector oil company in India.

The Andhra Pradesh government has already allocated close to 6,000 acres of land for the development, allowing early-stage site preparation and planning activities to move forward. BPCL has indicated a target commissioning timeline toward the end of the decade, with startup tentatively projected around 2030. Once operational, the project would play a key role in supporting BPCL’s broader ambition to raise its overall refining capacity from about 35 million tonnes per year to nearly 45 million tonnes per year.

In parallel, BPCL continues to advance the Bina Refinery Expansion and Petrochemicals Project, which involves increasing Bina’s capacity from 7.8 million tonnes per year to 11 million tonnes per year and installing a dual-feed cracker to produce ethylene and propylene. Approved in 2023 at an estimated cost of ₹490 billion (roughly $6 billion), the Bina project is targeted for commissioning by 2028. BPCL has also outlined potential incremental expansions at its Mumbai and Kochi refineries, indicating a multi-location approach to capacity growth rather than reliance on a single asset.

Logistics Integration

Beyond refining and petrochemicals, BPCL’s agreements with Oil India and Numaligarh Refinery Limited extend into product evacuation and logistics infrastructure, an area increasingly critical for downstream efficiency. A key proposal under the MoUs is the development of a multi-product pipeline linking Siliguri to Mughalsarai via Muzaffarpur, spanning roughly 700 kilometres.

The pipeline is designed to transport key petroleum products including motor spirit, high-speed diesel, and aviation turbine fuel, helping streamline movement from refining centres to demand hubs across eastern and central India. Estimated project cost stands at approximately ₹35 billion (about $397 million), with BPCL holding a 50% stake and OIL and NRL each owning 25%.

From a strategic standpoint, the pipeline would support NRL’s ongoing expansion of its Assam refinery capacity from 6 million to 9 million tonnes per year, while also integrating with planned crude import infrastructure at Paradip and a long-distance crude pipeline to Numaligarh. Collectively, these investments are intended to reduce transportation bottlenecks, lower logistics costs, and strengthen product supply reliability across multiple regions.

Green Energy Plans at Kerala

Under the third MOU, BPCL and FACT agreed to pursue a municipal solid waste (MSW)-based compressed biogas (CBG) plant at Brahmapuram near the Kochi refinery. The plant will process ~150 t/day of biodegradable waste to produce ~5.6 t/day of CBG, along with organic manure products, with FACT responsible for fertiliser marketing. BPCL estimates the project cost at ~₹900 million (~$10.2 million).

The initiative supports BPCL’s commitment to sustainability - including meeting net-zero Scope 1 and 2 emissions by 2040 - and aligns with India’s broader waste-to-energy and renewable fuel vision.

Strategic Implications & Risks

Together, these MOUs showcase BPCL’s integrated downstream strategy spanning refining, petrochemicals, logistics, renewable fuels, and fertilisers. The projects support the Atmanirbhar Bharat agenda - emphasising domestic capacity expansion, feedstock integration, and reduced import reliance - while positioning BPCL at the forefront of India’s east-coast refining growth.

However, deliverables to track include finalisation of the BPCL-OIL joint-venture structure, progress on the Siliguri- Mughalsarai pipeline, commissioning of the MSW-CBG plant, and evolving refining margins and feedstock pricing trends that could influence project economics.

Why this matters for Suppliers

BPCL’s downstream expansion plans are significant not only for capacity growth, but for the scale and composition of procurement they are likely to trigger across India’s heavy engineering and process equipment ecosystem. Large, integrated refinery- petrochemical complexes such as the proposed Ramayapatnam project typically generate sustained demand over multiple years for pressure vessels, heat exchangers, columns, reactors, piping spools, structural steel, and specialised filtration and separation equipment. For suppliers, the opportunity extends well beyond initial construction into revamps, de- bottlenecking, and long- term maintenance contracts.

The emphasis on petrochemical integration also alters the supplier mix. Ethylene crackers and associated downstream units require tighter tolerances, higher metallurgy standards, and greater fabrication precision compared to conventional fuel-oriented refining. This creates openings for vendors with proven capabilities in high-pressure systems, alloy handling, and stringent quality documentation, while raising entry barriers for purely commodity suppliers.

Logistics infrastructure investments, including product pipelines and terminal expansions, further broaden the scope for valve manufacturers, pipeline fabricators, coating specialists, and civil contractors. Importantly, multi-partner projects involving BPCL, Oil India and NRL are likely to follow structured, phased procurement processes, offering visibility and planning certainty for suppliers able to pre-qualify early.

Finally, BPCL’s parallel push into green energy projects- such as waste-to-CBG facilities- signals a diversification of procurement beyond traditional hydrocarbon equipment. For suppliers, this points to a gradual expansion of opportunity into adjacent energy-transition segments, without an abrupt decline in conventional oil and gas demand. Taken together, these developments suggest that BPCL’s expansion cycle could anchor a multi-year order pipeline for qualified suppliers across India’s downstream value chain.

| Project | Scope | Estimated CAPEX | Indicative Timeline |

|---|---|---|---|

| Ramayapatnam Integrated Refinery and Petrochemicals (Andhra Pradesh) | Greenfield crude refinery with integrated petrochemical complex and ethylene cracker | ~₹1 trillion (≈ US $11.4 billion) | Target commissioning around 2030 |

| Bina Refinery Expansion and Petrochemicals (Madhya Pradesh) | Capacity expansion (7.8 → 11 MMTPA) with dual-feed petrochemical cracker | ~₹490 billion (≈ US $6 billion) | Target commissioning around 2028 |

| Siliguri–Mughalasarai Product Pipeline | Multi-product pipeline (MS, HSD, ATF) supporting BPCL–OIL–NRL logistics integration | ~₹35 billion (≈ US $0.4 billion) | Mid-to-late 2020s |

| MSW-to-CBG Plant, Kochi (Kerala) | Municipal solid waste-based compressed biogas facility near Kochi refinery | ~₹0.9 billion (≈ US $10 million) | Mid-to-late 2020s |